Are you considering purchasing an iPhone in Pakistan? It’s important to understand the PTA tax regulations, as all imported mobile phones, including iPhones, are subject to taxes imposed by the Pakistan Telecommunication Authority (PTA).

If you are importing an iPhone 14 and have a passport, you should register your device using a valid passport within 30 days of import, as this option is cheaper. If you miss this window, you will need to register through your CNIC after one month of import, which incurs a slightly higher cost.

Taxes include PTA regulatory duty, customs charges, sales tax, and other duties as per DIRBS (Device Identification, Registration and Blocking System) regulations.

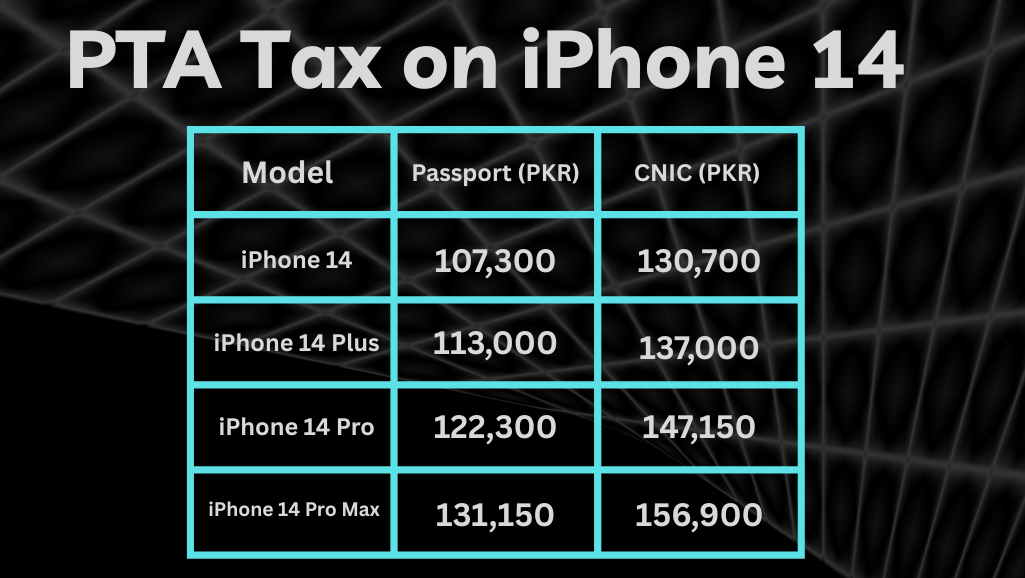

Here are the current PTA/DIRBS mobile regulatory taxes for iPhone 14 models in Pakistan 2025

| Model | Passport (PKR) | CNIC (PKR) |

|---|---|---|

| iPhone 14 | 107,300 | 130,700 |

| iPhone 14 Plus | 113,000 | 137,000 |

| iPhone 14 Pro | 122,300 | 147,150 |

| iPhone 14 Pro Max | 131,150 | 156,900 |

On a local SIM, it will only be blocked after 60 days.

Yes, using a passport typically results in savings of PKR 20,000 to 25,000.

Through approved banks or the PTA’s online DIRBS system.

Yes, but until the tax is paid, it will be blocked.

The article above provides a detailed discussion of the PTA tax related to the iPhone 14 series.

Send IMEI to 8484 or check on the DIRBS website.

Installments are available from some banks and online payment systems like KistPay.