Pakistan Telecommunication Authority (PTA) is the regulatory authority that monitors all telecom services in Pakistan and ensures that regulations regarding the internet, mobile networks, and gadget imports are followed.

What is PTA Tax?

PTA tax, also known as mobile registration tax in Pakistan, refers to the tax and registration fee charged by the Pakistan Telecommunication Authority (PTA) for allowing imported phones to connect with the local cellular network of Pakistan, especially with DIRBS (Device Identification Registration and Blocking System).

Once you get registered with PTA, you can connect your SIM networks in Pakistan. Its purpose is to prevent the use of unregistered or potentially illegal devices.

Why is PTA Tax Needed?

The PTA tax is necessary to discourage phone smuggling, ensuring that only legal and PTA-approved phones are used in Pakistan. This policy also generates revenue for the government. Unregistered phones get blocked from using SIM cards on Pakistani networks.

Why iPhone Users Need to Know About PTA Tax in Pakistan

The Apple iPhone users in Pakistan will be aware of the PTA tax, as iPhones are classified as high-end devices. These devices incur significantly high registration fees mandated by the Pakistan Telecommunication Authority.

If you have not registered your iPhone with PTA, then you have to face different consequences for it.

Consequences of Not Paying PTA Tax:

If you do not pay the PTA tax and fail to register your mobile phone in Pakistan, there are serious consequences:

- SIM Blocking (No Network Access) by PTA after 60 days of using a local SIM

- The phone is limited to using Wi-Fi only

- IMEI (International Mobile Equipment Identity) is blacklisting in the DIRBS system

- Legal Trouble for Businesses

- Dual-SIM Phones: One SIM May Work Temporarily for a Limited Time Eventually, both SIMs will be blocked.

- Low resale value if you try to sell your phone

PTA Tax Rates for iPhone 16 Series (2025)

The registration procedure determines the PTA tax for iPhone 16 models. The expected PTA taxes for iPhone 16 models in Pakistan in 2025 are listed as follows:

| iPhone Model | Passport (Rs) | CNIC (Rs) |

|---|---|---|

| iPhone 16 PTA Tax | 107,325 | 130,708 |

| iPhone 16 Plus PTA Tax | 113,075 | 137,033 |

| iPhone 16 Pro PTA Tax | 135,300 | 161,480 |

| iPhone 16 Pro Max PTA Tax | 148,500 | 176,000 |

How to Check and Pay PTA Tax:

Here’s a complete guide on how to check and pay PTA tax in Pakistan:

First Method: Check and Verify by SMS

- Find your phone’s IMEI number, then dial *#06# on your phone.

- Send IMEI number to 8484 on SMS.

- After that you will receive a detailed message from PTA showing the status of your device.

Second Method: Check Online (DIRBS Portal)

- Go to the official PTA DIRBS website.

- Enter your IMEI number in the box.

- Click on the “Check” button to know the current status.

Methods to Pay PTA Tax (Register Your Phone)

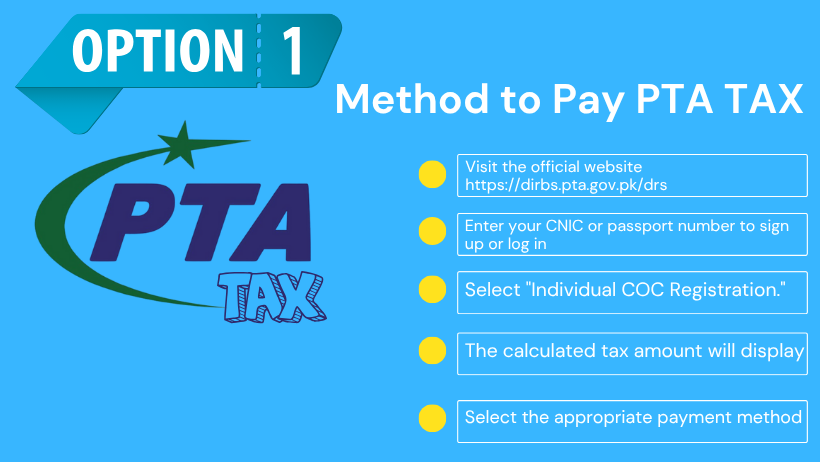

First Option: Online via PTA DIRBS Portal:

- Visit the official website https://dirbs.pta.gov.pk/drs

- Enter your CNIC or passport number to sign up or log in

- Select “Individual COC Registration.”

- Enter IMEI number

- The calculated tax amount will display

- Select the appropriate payment method

Your phone will be registered and PTA-approved within 1–3 working days.

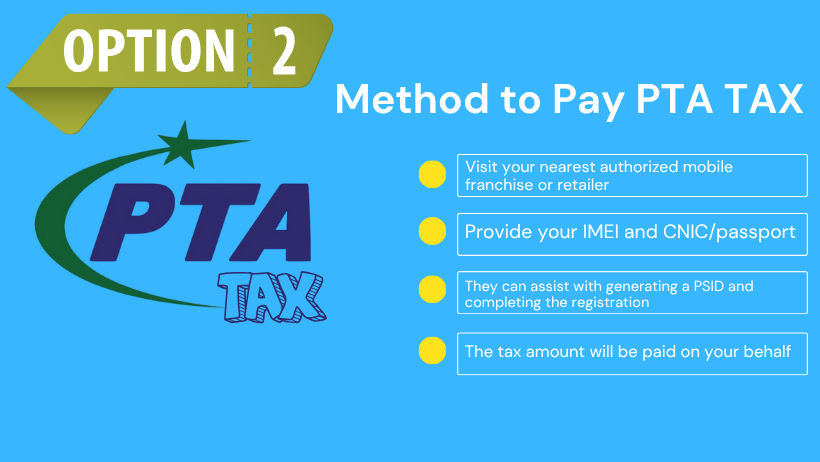

Second Option: Pay at a Mobile Shop/Franchise:

- Visit your nearest authorized mobile franchise or retailer

- Provide your IMEI and CNIC/passport

- They can assist with generating a PSID and completing the registration

- The tax amount will be paid on your behalf

Tips to Reduce PTA Tax Burden

- Use Passport for Registration instead of a CNIC; PTA tax is significantly lower when registering through your passport.

- Under Pakistan’s tax laws, you can bring one mobile phone per year as a duty-free gift for personal use; only registration is required through the DIRBS system.

- If you are living in Pakistan and want to buy a phone, buy a PTA-approved phone, which saves you the registration hassle and tax altogether.

- PTA tax is increased with the storage capacity, so opt for lower storage variants.

- Before registering, if possible, wait for their promotional periods to get tax relief.

- If you’re an overseas Pakistani or a tourist, you can get temporary PTA registration (valid for 120 days) for free, without paying tax.

- To avoid penalties/extra charges without any delay, register your device quickly.

Local PTA-Approved iPhone vs. Overseas Imported iPhone

Here’s a comparison table of local iPhone purchases vs. overseas imports, considering different key factors:

| Factor | Local PTA-Approved iPhone | Overseas Imported iPhone (Unregistered) |

|---|---|---|

| Device Cost | Higher | Lower |

| PTA Tax | Included | Separately paid |

| Registration Hassle | None | Must register within 30/60 days or get blocked |

| Risk of Blocking | None | High |

| Model Compatibility | Fully compatible | Some models may lack full LTE/5G band support |

| Total Cost (with tax) | Predictable | Variable (depends on tax rate & exchange rate) |

| Payment Method | Local | Usually requires full upfront payment abroad |

| Peace of Mind | Safe | Risk of issues |

Advice for Buyers Before Importing:

- Compare Total Costs

- Use a Passport if Possible

- Verify Model Compatibility

- Don’t Delay Registration

- Beware of Non-PTA Scams

Final Thoughts

Only when importing the iPhone 16 series at a considerably cheaper cost than purchasing locally may it be acceptable to pay PTA tax.

If you prioritize ease, legality, and having access to the entire network, then paying the PTA charge is acceptable. However, to lower your overall cost, look into alternative choices, including duty-free registration, buying locally, or choosing an older model.

Frequently Asked Questions:

Yes, you can use an iPhone without PTA approval for up to 60 days with a local SIM or 120 days through temporary registration for overseas visitors.

The PTA registration process typically takes 1 to 3 working days after payment is made.

If you don’t pay the PTA tax, your phone will be blocked from using local SIM cards after the allowed usage period.