In today’s world of competition smartphones has become an essential part of our lives due to their advance features and convenience. It gives access to internet, online banking, shopping, navigation, entertainment, business platforms and many other aspects because of all these it plays an extremely vital role in everyone’s life.

Customers prefer to purchase smartphones on installment plans because they can better manage their finances by choosing smaller monthly payments rather than a large upfront payment, and there are numerous platforms accessible these days that provide smartphones on installment plans.

The purchase value is raised by the additional benefits that installment plans provide, such as upgrades, insurance, or mobile data plans. All things considered, it’s an affordable method to keep up of technical developments.

Reasons to Consider Buying a Smartphone on Installment

- Reasonably priced monthly installments: No need to pay the full amount at once

- Availability of Luxury Models: It allows to purchase of high-end or latest models

- Interest-Free Plans: A lot of installment plans have no interest.

- Convenient Procedure: Fast and simple carrier or merchant approval

- Bundled Offers: These frequently come with extras like upgrades, insurance, or data service plans

- Builds or Enhances Credit: On-time payments have a favorable impact on credit history

Online vs Offline Options to Buy a Smartphone on Installments

| Factors | Online | Offline |

|---|---|---|

| Convenience | Shop anywhere at any time | Requires visiting a physical store. |

| Comparison | Easy to compare prices, models, and EMI options. | Limited to store availability |

| Documentation | Mostly digital and quick. | Involve more paperwork |

| Offers & Discounts | Frequent online-only deals, discounts, and cashback. | Store-specific offers |

| Delivery | Home delivery, often free | Immediate handover after purchase. |

| EMI Options | Wide range through banks, cards, and BNPL services. | EMI through in-store finance partners or banks. |

| Customer Support | Online chat or call support | Direct in-person help and instant support. |

- Online stores (e.g., Telemart.pk, Winstore.pk, Kistpay) offer better convenience and offers.

- Offline stores (e.g., authorized retail shops, mobile showrooms) offer personal assistance and immediate handover.

The best choice depends on user preferences for convenience and his personal interaction.

Types of Installment Plans

In Pakistan, various installment plans are available for purchasing smartphones. Consumers can choose the plan that best aligns with their financial situation and preferences.

Here’s an overview of the primary options:

Easy Monthly Installments (EMI) Credit Card: Many Banks like HBL, Bank Alfalah, MCB, UBL, JS Bank, Silk Bank, and Faysal Bank provide the facility of EMI plans for credit card holders. These plans often come with 0% markup for tenures ranging from 3 to 12 months.

Buy Now, Pay Later (BNPL) Services: Customers can purchase cellphones right away and pay for them over time via the BNPL platforms. Kistpay and Price Oye are the services offer flexible installment options, often without credit card.

Retailer-Based Installment Plans: Several retailers offer in-house installment schemes like AYS Online provides interest-free installment plans similarly Winstore.pk and M. Abdullah Electronics offers smartphones on installments.

Cardless Installment Platforms: Platforms like GetEMI.pk provide installment options without requiring a credit or debit card. They offer Shariah-compliant plans with tenures up to 12 months.

Factors to Consider Before Buying a Smartphone on Installment

- Total Cost (Including Markup/Interest)

- Monthly Installment Amount

- Tenure of the Plan

- Down Payment Requirement

- Type of Plan

- Eligibility Criteria

- Hidden Charges or Processing Fees

- After-Sales Service & Warranty

- Return and Exchange Policy

- Credibility of the Seller or Financier

Taking these things into consideration will assist you make an informed, economical, and stress-free installment purchase.

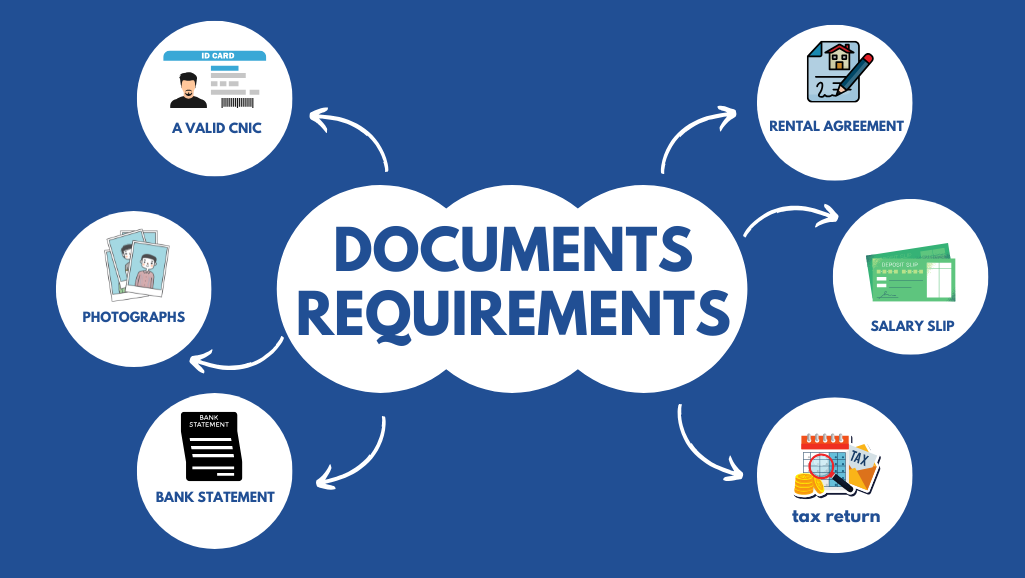

List of Documents and Requirements for Purchasing a Mobile Phone on Installment in Pakistan

- A valid CNIC is required for verification.

- Recent passport-sized photographs.

- Proof of source of income: salary slip, bank statement, or tax return.

- Proof of residence in the form of a utility bill or rental agreement.

- For contact or verification mobile number (registered to CNIC) required.

- Guarantor is optional, depending on the installment plan.

- Signed formal agreement/form outlining terms, conditions, and payment schedule.

Requirements may vary slightly depending on the seller, bank, or installment service provider.

Here’s a brief comparison of the Application Process for Buying a Mobile Phone on Installment in Pakistan via Online and Offline methods:

| Procedure | Online Process | Offline Process |

|---|---|---|

| Product Selection | Smartphone selection from an e- commerce or BNPL website. | Visit a mobile retailer |

| Choose Installment Plan | Choose an EMI, BNPL, or bank installment option at checkout. | Ask the store about their plans and offers |

| Filling Application Form | Fill out a digital form with CNIC, address, and personal info. | Fill out a physical form with personal details. |

| Documents Uploading | Upload Required documents | In-person or phone verification by store or financing company |

| Verification | Automated or call-based verification | In-person or phone verification by store or financing company. |

| Approval | Approval given instantly or within 24–48 hours. | Approval may take a few hours to a couple of days |

| Down Payment (if any) | Pay online | Pay in cash or via card at the store. |

| Product Delivery | Phone is delivered to your home. | Phone is handed over immediately |

| EMI Start | EMI auto-debited monthly from bank/card. | EMI paid via bank, cheque , or cash as decided. |

Pros and Cons of Buying a Smartphone on Installments: Here is a table showing the Pros and Cons of Buying a Smartphone on Installments in Pakistan:

Pros

- Affordable Monthly Payments

- Access to Latest Models

- No/Low Upfront Cost

- Flexible Tenures

- Convenient Online Options

- Builds Credit History

- Bundled Offers

Cons

- Higher Total Cost

- Eligibility Requirements.

- Late Payment Penalties

- Limited Availability

- Credit Dependency

- Contract Commitments

- Approval Delays